- Investinq

- Posts

- 🧏🏻♂️ Apple AirPods Pro 2... Hearing Aid?

🧏🏻♂️ Apple AirPods Pro 2... Hearing Aid?

+ Intel’s Next Move — Foundry Freedom and AI Play

Good afternoon! The Ig Nobel Prize isn’t your average award ceremony. Forget groundbreaking discoveries in medicine or physics — this quirky counterpart to the Nobel Prize honors offbeat, imaginative, and downright strange research that makes people laugh, then think. Held annually at MIT, the Ig Nobels celebrate scientific achievements that you probably didn’t know you needed, but will definitely want to hear about.

This year, a Japanese research team snagged the Ig Nobel Prize in physiology for discovering that mammals can breathe through their anuses. Yep, you read that right. Their study suggests this odd capability could offer an alternative method for oxygenating critically ill patients when ventilators are in short supply. Other eyebrow-raising winners explored everything from how plants mimic plastic leaves to separating drunk worms from sober ones, all in the name of science and good humor.

MARKETS

Stocks had a mixed Monday, with tech stocks stumbling ahead of a crucial week. The Dow soared to a new record, closing at 41,622 thanks to a 6% surge from Intel. Meanwhile, the S&P 500 squeezed out a 0.13% gain, but the Nasdaq wasn’t as lucky, slipping 0.52% as traders pulled money from tech giants. All eyes are on the Federal Reserve’s big decision, with many expecting the first interest rate cut in four years.

Speaking of the Fed, the odds for a half-point cut on Wednesday have jumped to 60%, up from 50-50 just last week. With that looming, investors started funneling cash into more economically sensitive sectors, leaving the tech darlings behind. While the S&P barely budged, most of its stocks still found some green.

STOCKS

Winners & Losers

What’s up 📈

Nuvalent ($NUVL) soared 28.27%, reaching an all-time high, after reporting positive data on two experimental cancer treatments. The company stated that the drugs showed “favorable tolerability.”

Icahn Enterprises ($IEP) surged 14.54% following the dismissal of a proposed class action lawsuit against the company and its executives.

Carvana ($CVNA) gained 7.75% after Evercore ISI analysts raised their price target from $142 to $157, citing the company’s strong positioning in the used car market.

Intel ($INTC) jumped 6.36% after announcing plans to transform its foundry business into an independent unit with its own board, potentially raising outside capital.

Oracle ($ORCL) climbed 5.12% as Jefferies analysts increased their price target from $170 to $190. Melius Research also upgraded Oracle shares to a "buy" rating.

Zillow ($Z) rose 4.77% after being upgraded to outperform by Wedbush. Analysts pointed to falling mortgage rates and growth in its software and services business as potential catalysts.

CrowdStrike ($CRWD) inched up 3.35%.

What’s down 📉

BioMarin Pharmaceutical ($BMRN) dropped 17.71% following the release of promising test results from Ascendis Pharma for a growth treatment that could rival BioMarin's approved drug, Voxzogo.

Upstart ($UPST) fell 7.65% after the company announced a new debt offering, selling $300 million of convertible notes due in 2029 for various uses, including repurchasing other bonds and general corporate purposes.

Arm Holdings ($ARM) slid 6.09%, as a key supplier to the Apple iPhone, after a prominent Asia-based Apple analyst reported weaker-than-expected initial orders for the iPhone 16.

MicroStrategy ($MSTR) declined 4.91% after announcing a proposed private offering of $700 million in convertible senior notes.

Micron Technology ($MU) dropped 4.43% after Morgan Stanley lowered its price target, reiterating its equal weight rating and raising concerns about Micron’s growth.

Apple ($AAPL) slipped 2.78% after reports of weaker-than-expected demand for some of the company’s latest iPhone models. Analysts cited iPhone 16 demand down 12% compared to first-weekend sales for the iPhone 15.

Lucid Group ($LCID) fell 4.31%.

TECH

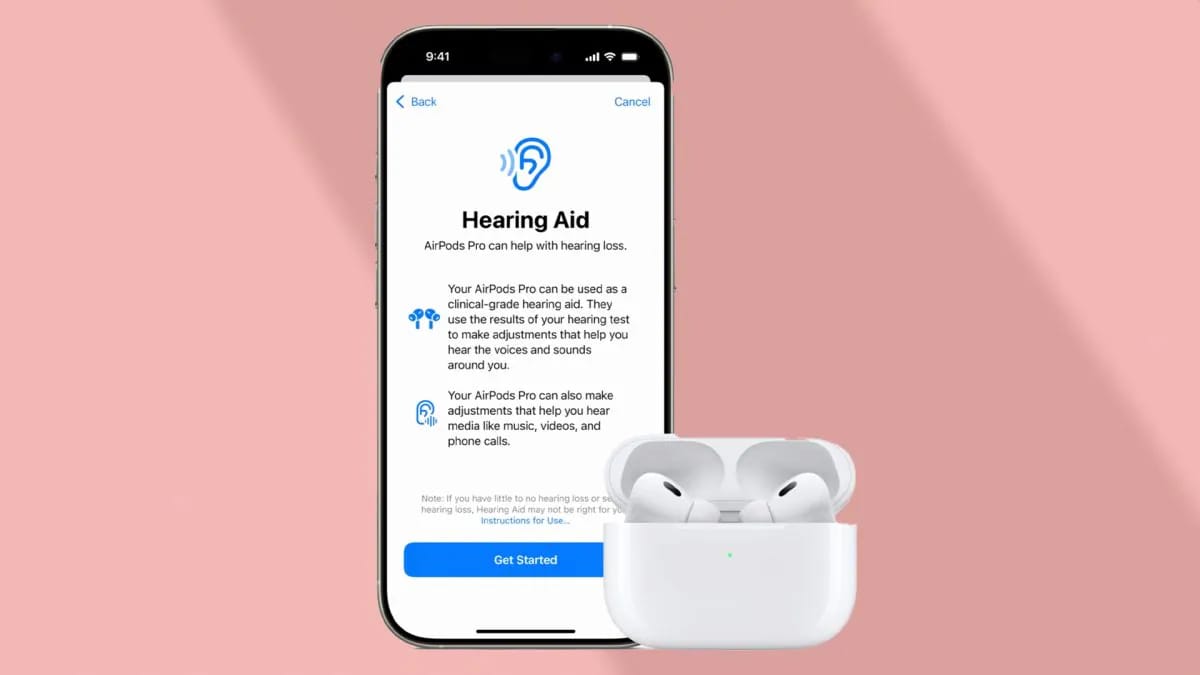

Apple’s AirPods Pro 2 — Changing the Hearing Aid Game

Apple is about to revolutionize the hearing aid game, and it's doing it through your trusty AirPods Pro 2. In a surprising move, the tech giant announced a major upgrade to its AirPods Pro 2, turning them into a potential game-changer for those with hearing loss. With FDA approval expected this fall, these earbuds will now feature a “clinical-grade” hearing aid function that could redefine accessibility for millions. Forget the need for expensive, traditional hearing aids—Apple is offering a sleek, budget-friendly alternative.

This update means existing AirPods Pro 2 users (and future buyers) will have access to over-the-counter hearing aid software, with no doctor's visit required. By taking a simple five-minute hearing test at home, users can create a personalized hearing profile that amplifies sounds based on their specific needs. Apple isn’t just offering a quick fix—it’s providing a comprehensive solution that lets users manage their hearing health from the comfort of their iPhone or iPad.

A Cheaper, Sleeker Solution

At $249, the AirPods Pro 2 are far more affordable than most hearing aids on the market, which often come with a hefty price tag that can soar into the thousands. For comparison, Sony’s CRE-E10 OTC hearing aids cost $1,099, while Jabra’s options start at $995. Apple’s approach significantly undercuts these prices, making hearing aids more accessible to those who may have previously avoided them due to cost or stigma.

Speaking of stigma, the AirPods Pro 2 are set to break down barriers. Unlike traditional hearing aids that can be bulky or noticeable, AirPods are already a common sight. You could pop them in to listen to music, take a call, or—thanks to this new feature—enhance your hearing without anyone being the wiser. This blend of functionality and subtlety could be a game-changer, especially for those who have been hesitant to seek help for hearing loss.

Not Without Its Limits

Despite all the excitement, there are a few caveats to consider. For starters, the battery life might be an issue. With about six hours of listening time on a single charge, the AirPods Pro 2 aren’t exactly designed for all-day use as hearing aids. Compare that to Sony’s CRE-E10, which offers a whopping 26 hours, and it’s clear Apple’s product has some room for improvement in this area.

Another factor to keep in mind: you’ll need an iPhone or iPad running iOS 18 or newer to unlock these features. While this may not be a deal-breaker for most Apple users, it’s something to note if you’re using older tech. Still, considering the affordability and convenience of having a hearing aid that also doubles as high-quality earbuds, the AirPods Pro 2 could become a go-to solution for millions of people with mild to moderate hearing loss.

NEWS

Market Movements

📺 Disney and DirecTV Reach Agreement: Disney ($DIS) and DirecTV reached a deal over the weekend to restore Disney’s networks, just in time for college football, to more than 11 million customers after a blackout that began on Sept. 1.

✈️ Boeing Strike Enters Fourth Day: The Boeing ($BA) factory worker strike has entered its fourth day, with negotiations between union leaders and Boeing set to resume on Tuesday. A prolonged strike could exacerbate Boeing's financial issues.

📦 Shein and Temu Face Price Hikes: Prices at Shein and Temu ($PDD) could rise by up to 20% if the Biden administration closes the de minimis loophole, which allows packages under a certain value to bypass import duties. This could affect their U.S. market competitiveness.

🎯 Target’s Holiday Hiring Plans: Target ($TGT) plans to hire 100,000 seasonal workers for the 2024 holiday season, maintaining staffing levels from the past three years. The hiring comes amid expectations of the slowest holiday retail sales growth in six years due to inflation.

🏠 Home Depot Settles False Advertising Case: Home Depot ($HD) will pay nearly $2 million to settle claims of false advertising in California, where customers were reportedly charged more than the listed price at checkout.

💼 Amazon Orders Full Return to Office: Amazon ($AMZN) is requiring corporate employees to return to the office five days a week, effective Jan. 2, 2025. Previously, Amazon only mandated three days in the office per week.

⌛️ Nippon Steel’s Bid for U.S. Steel Faces Delays: The Biden administration is likely to delay a decision on Nippon Steel’s $15 billion bid for U.S. Steel due to political concerns, including national security risks and potential job losses.

✂️ Boeing Implements Cost-Cutting Measures: Boeing ($BA) has frozen hiring and reduced supplier spending to conserve cash as it navigates the ongoing strike. The company is also considering temporary furloughs while attempting to reach a new labor agreement.

STOCK

Intel’s Next Move — Foundry Freedom and AI Play

Intel’s not giving up yet. In a bold bid to turn things around, the company just announced it’s spinning off its foundry business into a separate entity, sending its stock up 8% after hours. The goal? Give the foundry its own board, access to outside funding, and a chance to stop being such a money pit (it’s been soaking up $25 billion a year). This move is part of CEO Pat Gelsinger’s plan to breathe new life into the struggling chipmaker, which has lost nearly 60% of its value this year.

But that’s not all on Intel’s plate. They’re teaming up with Amazon Web Services to develop custom AI chips, marking a big step into the fast-growing AI server chip market. With Nvidia dominating that space, Intel’s clearly looking for a way back in.

Scaling Back Overseas, But Not at Home

In other news, Intel’s pumping the brakes on some of its European projects. Construction on new plants in Germany and Poland is getting delayed by two years due to lower demand, while a plant in Malaysia is getting paused altogether. U.S. factories, though, are safe from the chopping block, and Intel just scored $3 billion from the Biden administration to boost domestic chip production for defense purposes.

Intel’s also on a major cost-cutting spree, with plans to trim its workforce by 15% and cut down office locations by two-thirds. Gelsinger’s strategy? Simplify operations and get Intel back in the game.

Intel’s AI Gamble

While Nvidia’s been raking in the big bucks in the AI chip world, Intel’s ready to fight for its piece of the pie. The new partnership with Amazon could help Intel make waves in the custom AI chip market—an area expected to see explosive growth.

Gelsinger knows the pressure’s on. "All eyes are on us," he said, and Intel will need to execute these new strategies flawlessly if it hopes to silence its critics and stage a successful comeback.

Calendar

On The Horizon

Tomorrow

Looks like tomorrow’s a snoozer on the earnings front, so let’s focus on the next big thing: US Retail Sales. Dropping courtesy of the Census Bureau, this report is the go-to for understanding how Americans are spending (or saving) their cash. Last month, retail sales climbed 1% from the previous month and 2.7% year-over-year, defying inflation concerns. But with retailers warning of tighter consumer wallets, this next report will reveal if spending is about to take a hit or if shoppers are still swiping those cards.

Meanwhile, the housing market has its own update with the Home Builder Confidence Index. The sentiment hit rock bottom last month, sinking to 39—its lowest since December 2023—thanks to sky-high interest rates and unaffordable home prices. Sure, interest rate cuts could be on the horizon, but don’t expect builders to throw a parade just yet. Until mortgage rates dip, confidence likely won’t see a big boost.

NEWS

The Daily Rundown

🏌️♂️ Trump Assassination Attempt Foiled: A Secret Service agent thwarted a second assassination attempt on Donald Trump at his West Palm Beach golf course after spotting a rifle aimed at the former president.

🎬 Shōgun Sweeps Emmys: FX's Shōgun dominated the Emmys with 18 wins, including Best Drama, Best Actor, and Best Actress, setting a record for the most awards won by a single show in a year.

🛡️ Elon Musk’s Costly Security Detail: Elon Musk's security detail consists of over 20 guards and costs millions annually, far outspending other tech executives like Mark Zuckerberg and Tim Cook.

💸 Beetlejuice Sequel Continues Box Office Reign: Beetlejuice maintained its lead at the domestic box office with $51 million over the weekend, bringing its global total to $264.3 million.

🚀 SpaceX’s Polaris Crew Completes Mission: SpaceX’s Polaris mission crew returned to Earth after five days in orbit, completing the first private spacewalk.

👔 Rupert Murdoch's Succession Plan Dispute: The battle over Rupert Murdoch's media empire is heating up, as he plans to alter his succession plan to leave his eldest son, Lachlan, in sole control of his media outlets.

🌱 Hart House Shuts Down LA Locations: Hart House, the vegan fast-food chain fronted by actor Kevin Hart, closed all four of its LA locations. The brand posted a “hartfelt goodbye” on Instagram, signaling the end of its national expansion dreams just two years after launching.

📅 First Day of Fall: Sunday marks the official start of fall, though pumpkin spice lattes have already been a staple for weeks.

RESOURCES

The Federal Reserve Resource

Join our small yet growing subreddit 🚀: https://www.reddit.com/r/investinq/

Wall Street Reads 💎 (Best Books):

Stock Market Books📚

https://drive.google.com/file/d/1NQ-vdLE1afXFcc5PwDRp1d5VSHzDly88/view?usp=sharingOptions Trading Books📗 https://drive.google.com/file/d/1xeYL3IpjT623CJpO_Ole1Z-GuzHQQJzg/view?usp=sharing

Business Books 📖https://drive.google.com/file/d/1VfuTqhPVB2YjDOd0N56UhF6kmZU-kLci/view?usp=sharing

Check out our latest issues 🎯: https://investinq.beehiiv.com