- Investinq

- Posts

- 🃏 Cards Against Elon: $15M Battle Begins

🃏 Cards Against Elon: $15M Battle Begins

+ Meta Connect 2024: AR Glasses, Cheaper VR, and a Heavy Dose of AI

Good afternoon! Boeing is cranking up the charm with its latest offer to striking machinists: a 30% pay bump over four years (because 25% just wasn’t cutting it) and a doubled ratification bonus of $6,000. Toss in some restored annual bonuses and beefed-up 401(k) contributions, and you've got yourself a deal... maybe. Union members have until Sept. 27 to decide if Boeing’s offer flies, while the company reassures it’s keeping the next big airplane project in the union-friendly Pacific Northwest.

The strike kicked off on Sept. 13 after workers gave a hard pass on the previous deal. Negotiations were short-lived last week, and the big elephant in the room—pensions that were axed in 2014—remains off the table. Meanwhile, Boeing’s burning cash like a jet fuel fire, slapping on hiring freezes and exec pay cuts to handle the billion-dollar drain from the walkout.

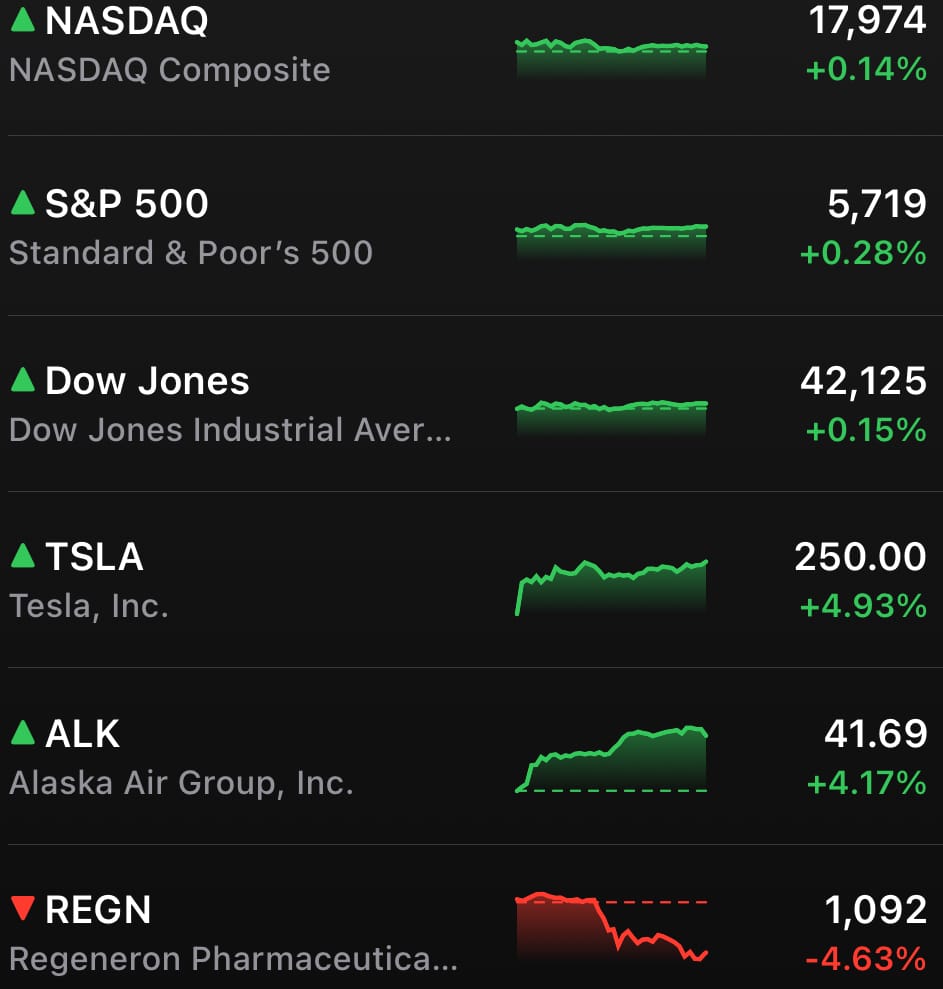

MARKETS

*Stock data as of market close, crypto data as of 5pm CST*

U.S. stocks inched higher on Monday as traders parsed through Federal Reserve commentary, still riding the wave of last week’s 50-basis-point rate cut. The S&P 500 nudged up 0.28%, getting cozy with its all-time high, while the Dow and Nasdaq didn’t want to be left out, both closing at record levels.

It’s been a winning streak on Wall Street since the Fed cut rates for the first time in four years. Investors are keeping their ears perked for any Fed hints about what’s next while the U.S. economy shows signs of strength, especially in the services sector. The soft-landing narrative? Still very much alive.

STOCKS

Winners & Losers

What’s up 📈

Tesla ($TSLA) increased 4.93% after Barclays reiterated its equal weight rating, stating that Tesla's third-quarter delivery numbers might surpass expectations, providing a near-term boost.

Alaska Airlines ($ALK) rose 4.17% after announcing a leadership change in its cargo division, following its acquisition of Hawaiian Airlines. The airline is adding new expertise in international cargo operations, essential for Amazon's inherited flying service.

Cloudflare ($NET) gained 3.83% after unveiling AI Audit, a suite of tools designed to help websites manage how their content is used by AI models.

Intel ($INTC) increased 3.30% following reports from Bloomberg and CNBC. Apollo Global Management proposed a multibillion-dollar investment in Intel, and Qualcomm reportedly approached the company about a takeover.

Micron Technology ($MU) rose 2.94% after JPMorgan reiterated its overweight rating ahead of the company's upcoming earnings, with expectations of strong demand from AI and server markets.

Sea Ltd. ($SE) climbed 5.79%.

JD.com ($JD) ticked up 4.24%.

First Solar ($FSLR) ticked up 3.78%.

What’s down 📉

Trump Media ($DJT) plunged 10.33% as shares sank to their lowest level since 2021, following the approval for Donald Trump and other insiders to begin selling their stakes in the Truth Social operator.

Regeneron Pharmaceuticals ($REGN) dropped 4.63% after a judge unexpectedly rejected an injunction aimed at preventing Amgen from launching a biosimilar version of its eye drug, Eylea.

Moody’s Corporation ($MCO) declined 3.17% after Raymond James downgraded the stock from a "market perform" to an "underperform" rating.

Instacart ($CART) fell 4.56%.

REAL ESTATE

Cards Against Humanity to Elon Musk: "Go F*** Yourself!"

This party game company sued SpaceX for a $15M property trespass—and throws in some spicy words for good measure.

Cards Against Humanity (CAH) just served Elon Musk’s SpaceX a $15 million lawsuit, claiming the aerospace giant has been treating their Texas land like its own personal junkyard. The card game company, famous for making you feel just a little uncomfortable at game night, bought the land back in 2017 as part of a stunt to block Trump’s border wall plans.

Now, CAH says SpaceX has rolled in uninvited, parking cars, stacking debris, and generally trashing the place. When confronted, SpaceX reportedly offered a “lowball” deal to buy the land—at less than half its value. CAH’s response? “Go f*** yourself, Elon.”

"Wait—Cards Against Who?": In case you missed the 2017 newsflash, CAH raised around $2.25 million from supporters to buy land in Cameron County, Texas, with the express goal of making life harder for Trump’s border wall construction. The plot was left in its “natural state,” with wild horses (allegedly) roaming free. But recently, SpaceX’s construction activities—like compacting soil and setting up generators—have, according to CAH, turned the land into a space-age parking lot.

The Stakes? Wild Vegetation—and Customer Trust: CAH’s complaint goes beyond crushed plants. They argue that SpaceX’s invasion has damaged their precious brand-customer relationship. And let’s be honest—nothing says “we’re here to fight for your rights” like defending a piece of borderland against the world’s richest man. They’re worried that fans might start thinking they’re somehow in cahoots with SpaceX, which is a big no-no for a company that thrives on anti-establishment vibes.

Meanwhile, SpaceX has been beefing with other locals too. Residents in the nearby village of Boca Chica say SpaceX has taken over their town—complete with statue removals and sign teardowns. Because, of course, space domination starts at home.

If CAH wins the lawsuit, each donor will see a nice little payday—about $100—on their $15 contribution. That’s a 700% return, folks. Maybe the real winning card is legal action after all.

NEWS

Market Movements

🌑 OpenAI’s Sneak Peek at a New Logo Flops: OpenAI revealed a potential new logo — a large black “O” — to its staff, but the reception wasn’t great. Employees criticized it for being ominous and lacking creativity.

🤖 Jony Ive Teams Up with Sam Altman: Legendary iPhone designer Jony Ive confirmed that he’s collaborating with Sam Altman on AI hardware. The project, funded by Lauren Powell Jobs, has been rumored for a while.

💉 FTC Targets Insulin Price Hikes: The FTC is suing three pharmacy benefit managers — Caremark Rx, Express Scripts, and OptumRx — for inflating the cost of insulin. Over the past 20 years, insulin prices have jumped by 600%.

🎈 Space Perspective's Test Soars: Space Perspective, a company offering balloon rides to the edge of space, completed a successful six-hour test in Florida, reaching 100K feet in altitude.

💵 Apollo Backs Intel with $5B Proposal: Apollo Global Management has proposed investing up to $5B in Intel ($INTC). Intel, undergoing operational and product revamps, is reviewing the offer.

🚗 GM to Lay Off Nearly 1,700 Workers: General Motors ($GM) is laying off 1,695 workers at its Fairfax Assembly plant in Kansas starting November 18, affecting both full-time and temporary employees.

🛩️ Boeing Defense Chief Exits: Boeing’s ($BA) defense unit head, Ted Colbert, is leaving the company immediately. COO Steve Parker will take over temporarily. The defense division accounted for 40% of Boeing’s revenue in the first half of 2024.

🏦 Bank of America’s Branch Expansion: Bank of America ($BAC) plans to open over 165 new branches across the U.S. by 2026, with 40 branches set to launch this year as part of its revenue-boosting strategy.

TECH

Meta Connect 2024: AR Glasses, Cheaper VR, and a Heavy Dose of AI

Mark your calendars, tech fans. Meta’s annual Connect developer conference kicks off on September 25th, and it's shaping up to be a buffet of VR, AR, and AI goodies. Expect new hardware, upgraded smart glasses, and AI innovations sprinkled across Meta's platforms like an everything-bagel seasoning.

Meta CEO and part-time metaverse evangelist Mark Zuckerberg will lead the keynote, which you can catch on Meta’s website or Horizon Worlds (if you’re living that VR life). Alongside him will be CTO Andrew Bosworth, who will dive deeper into all things AI and AR.

What's Coming?

Here’s the big stuff Meta might have in store:

A New, Cheaper VR Headset: Word on the street is Meta will unveil a stripped-down version of the Quest 3, the "Quest 3S," priced at a more wallet-friendly $299. The goal? Offer a VR experience that doesn’t break the bank, without sacrificing too much of the Quest 3’s tech magic. If leaks are accurate, this model could bridge the gap between the aging Quest 2 and the pricey Quest 3.

Smart Glasses 2.0: Meta’s Ray-Ban smart glasses are due for an update, and rumors suggest they’ll be getting some AI juice. While the glasses won't quite be AR wizards yet, they’re expected to bring new features, like voice-controlled AI, straight to your stylish shades. Plus, we might get a glimpse of “Orion,” Meta’s true AR glasses that could change how we see (literally) reality.

AI All Day, Every Day: AI will be the star of the show, with Meta expected to roll out new chatbot assistants, smarter AI-powered tools, and possibly some celebrity avatars. Llama 3.1, Meta’s latest large language model, will likely pop up across Meta’s platforms—think WhatsApp and Instagram with even more AI sass.

The keynote kicks off at 1 PM ET / 10 AM PT on September 25th. You can stream it via the Meta Connect website, Facebook, or catch it live in VR on Horizon Worlds.

Calendar

On The Horizon

Tomorrow

Get ready for a busy week of economic updates, kicking off with the S&P Case-Shiller home price index. Last month’s report showed a 5.4% jump in home prices for June, setting a new all-time high for the fourth straight month. Spoiler alert: July probably won’t break the trend, but everyone’s hoping future rate cuts will bring mortgage rates—and home prices—down eventually.

Next up, we’ll get a read on US consumer confidence. While the mood improved between July and August, concerns about the job market crept up, and stock market jitters didn’t help either (thanks, August volatility). But after a surprisingly strong September, maybe shoppers are feeling a bit more optimistic.

Before Market Open:

Autozone ($AZO) has revved up nearly 18% in 2024, fueled by an ambitious share buyback strategy over the past few years. But under the hood, last quarter’s earnings show a few warning lights: same-store sales were stagnant, and free cash flow is starting to slow. With consumer spending tightening, investors are eager to hear how management plans to steer things back on track—otherwise, Autozone’s impressive run could hit a dead end. Analysts expect $53.53 EPS on $6.22 billion in revenue.

NEWS

The Daily Rundown

🏀 WNBA Playoffs Begin with Record-Breaking Momentum: The WNBA playoffs kicked off following a historic regular season. Caitlin Clark, now a household name, was unanimously named Rookie of the Year, while A’ja Wilson claimed her second MVP title. Clark’s influence has driven massive TV ratings and packed arenas, signaling a transformative moment for women’s professional sports. Despite the Indiana Fever's playoff struggles, excitement around Clark and the league continues to grow, and the WNBA’s new media rights deal will more than triple its payout starting in 2026.

🌍 X to Return to Brazil After Meeting Court Demands: Elon Musk’s social platform X is set to return to Brazil after complying with legal orders, including appointing a legal representative and removing problematic accounts. The move resolves the issues that led to the platform's temporary ban.

🇮🇱 US Urges Israel to Avoid Escalation with Hezbollah: The Biden administration has advised Israel against escalating its conflict with Hezbollah, urging diplomacy as tensions rise on the Lebanon border. Israel, however, has vowed to continue military action until the northern region is secure.

🏨 Oyo Acquires Motel 6 for $525 Million: Indian hotel chain Oyo has expanded its North American presence with the purchase of Motel 6 from Blackstone for $525 million. The deal adds 1,500 Motel 6 locations to Oyo’s growing portfolio in the US.

📺 Friends Turns 30: Yesterday marked the 30th anniversary of Friends, the iconic sitcom that remains a cultural force. Despite ending in 2004, the show continues to thrive on streaming platforms, with WarnerMedia licensing it to Netflix for $100 million in 2018.

🗓️ UN General Assembly Kicks Off in NYC: Over 140 world leaders are gathering for the UN General Assembly this week, causing significant traffic disruptions in Manhattan. Drivers are advised to find alternate routes due to street closures.

🎤 SNL's 50th Season Premiere: Saturday Night Live returns for its 50th season this weekend, with Hacks star Jean Smart hosting and Jelly Roll as the musical guest. Maya Rudolph will reprise her role as Kamala Harris as the 2024 election draws closer.

RESOURCES

The Federal Reserve Resource

Join our small yet growing subreddit 🚀: https://www.reddit.com/r/investinq/

Wall Street Reads 💎 (Best Books):

Stock Market Books📚

https://drive.google.com/file/d/1NQ-vdLE1afXFcc5PwDRp1d5VSHzDly88/view?usp=sharingOptions Trading Books📗 https://drive.google.com/file/d/1xeYL3IpjT623CJpO_Ole1Z-GuzHQQJzg/view?usp=sharing

Business Books 📖https://drive.google.com/file/d/1VfuTqhPVB2YjDOd0N56UhF6kmZU-kLci/view?usp=sharing

Check out our latest issues 🎯: https://investinq.beehiiv.com